Our newest Archivist Lawrence Barker pins down where composer Gustav Holst wrote his famous Planets suite…

It was about a hundred years ago that the composer Gustav Holst started work on his masterpiece, The Planets suite, and at the same time, to spend weekends at Thaxted. He started with Mars “The bringer of war” shortly before the First World War broke out, and much has been made of the coincidence. However, apparently Holst always denied that he had had a premonition of the horrors of war that were to ensue.

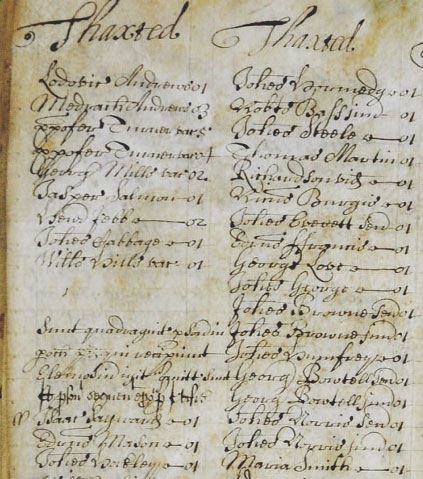

Like many I am sure, I had assumed that the house in the middle of Thaxted, identified now by a blue plaque, was where he wrote The Planets. But, as the plaque confirms, he only moved into that house in 1917 after he had completed the work. Before then, he rented what his daughter Imogen described as a ‘three-hundred-year-old cottage on the top of a hill…two miles from Thaxted’[1] in the small hamlet of Monk Street, which had been previously occupied by the writer S.L. Bensusan. It was there that he wrote Mars.

Sadly, the cottage no longer exists but a photograph does exist of the interior (which you can see here) showing Holst’s wife Isobel sitting by the fire and possibly taken by Holst himself. The grand piano also visible in the left foreground is recognizably the same as that which Holst bought for the cottage which now takes pride of place in the Holst birthplace museum at Cheltenham, with a score of The Planets placed on the music stand and a note claiming that it was composed on that piano. Holst bought it because it had a very light action which suited his neuritis.

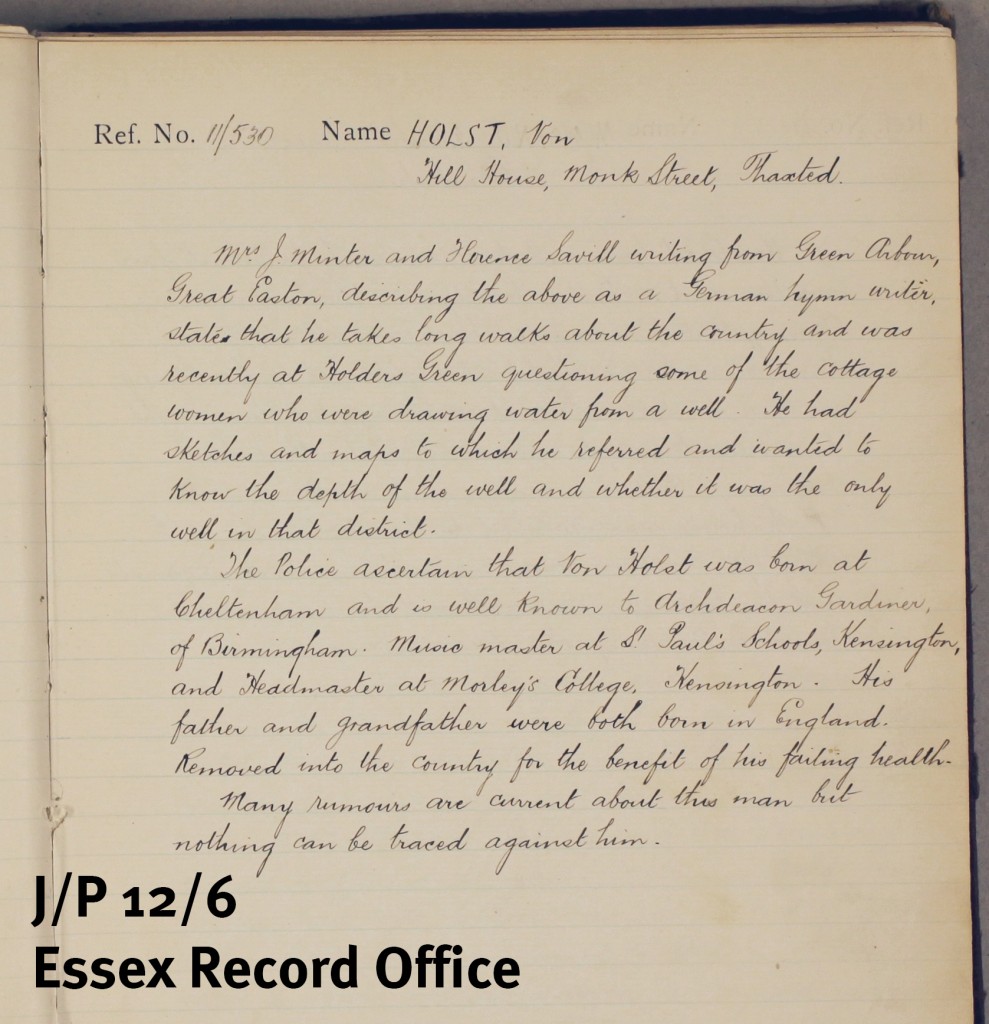

At the time, Holst called himself Von Holst as is confirmed by his entry in the 1911 census. Imogen describes how he helped out with the music in the church and was affectionately called ‘our Mr. Von’ by singers in the church choir. However, with the onset of the First World War, neighbours became suspicious of him walking around the district and asking questions about the history of the area. He was reported to the local police who carried out an investigation under the terms of the Aliens Restriction Order; and you can read the outcome reported below in a book of police investigations of those with German associations (J/P 12/6, 1914-18) kept by the ERO. Usefully, you can see that the book states his address at the time as ‘Hill House, Monk Street, Thaxted’.

Holst later took steps to have ‘Von’ formally removed from his name and paid for a change in the deed poll. However, ironically, as Imogen relates, he was not entitled to call himself ‘Von’ Holst in any case as the title was initiated as an affectation by his father in the 1880s to increase his kudos by advertising himself as a German music teacher.

As the cottage has disappeared, I thought I would try and find its exact location by carrying out a typical house-history search.

Imogen Holst described the cottage in a small pamphlet about her father and Thaxted published in 1974:

The cottage dated from 1614; it had a thatched roof, and open fire-places, and a wonderful view across meadows and willow trees to the church spire in the distance.[2]

The NW volume of the Royal Commission on Historic Monuments for Essex has an entry for such a cottage on the Dunmow Road, East side:

(37). Cottage, about 1½ m. S. by E. of the church, was built apparently in 1614, and has a modern wing at the back and a low modern addition at the N. end. On the W. font are three gabled dormer windows; the middle window is dated 1614.

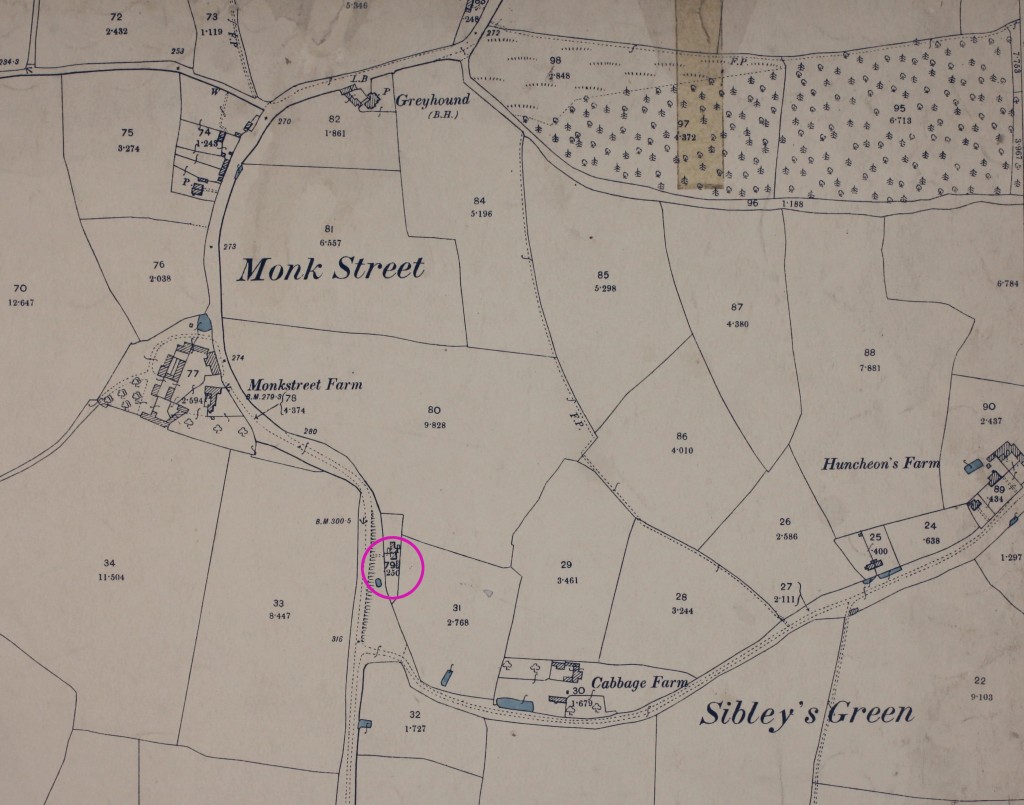

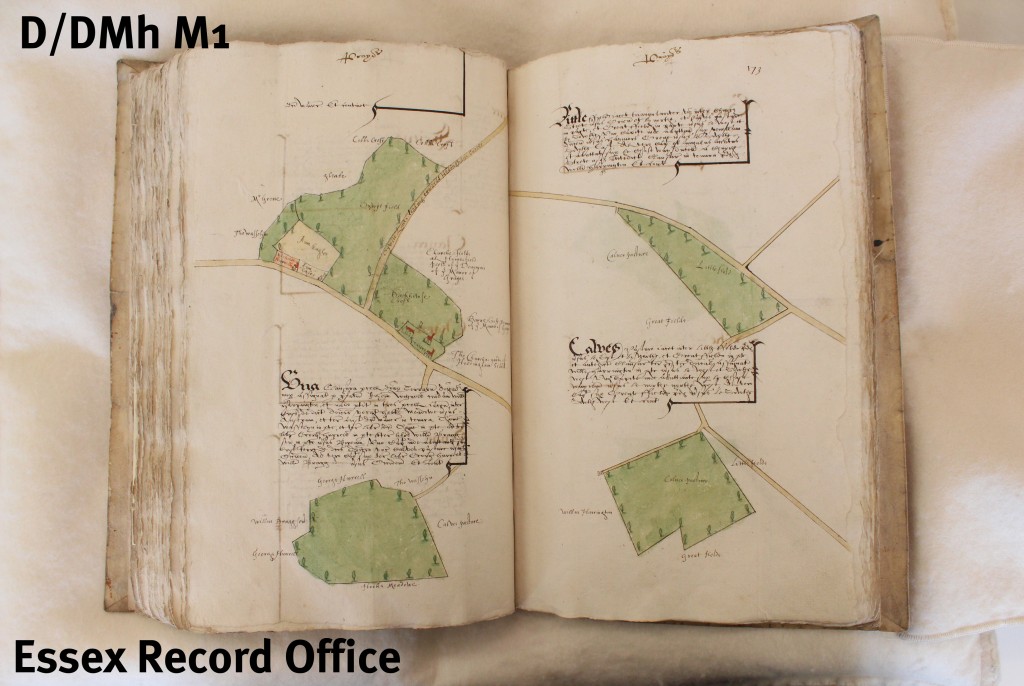

The map shows it to be located on the right going towards Thaxted just before the road bends to the left into the hamlet of Monk Street.

The cottage was owned by Bensusan, and this is confirmed on the 1910 Finance Act map based on OS 25″ 2nd ed. sheet XIV.16 (ERO reference A/R 1/3/14), which shows the cottage to be plot 743 (79 on OS map) with the ownership of Bensusan confirmed in pencil on the map; that is, the second cottage past the turning to Sibley’s Green to the South and just before the left bend into Monk Street to the North on the Thaxted road (now the B184). The accompanying reference book (A/R 2/5/10) shows on pg. 72 that assessment no. 743 was a vacant cottage (extent 1/3 Rod) owned by Samuel Bensusan (of The Brick House, Gt Easton) in Monk Street. This was the only cottage in Monk Street belonging to Bensusan.

Armed with the name of the cottage, I carried out a search on Seax for any other documentation that might survive about it and found two bundles of documents. The first (D/F 35/8/308) concerned ‘Hill Cottage’, Monk St., which underwent repairs, including the thatch, in 1924. It was leased to Mrs Kennedy and correspondence contained in an envelope dated 1924 referred to the ‘Monk St property belonging to S. L. Bensusan Esq.’. The other bundle (D/F 35/8/342) includes an agreement between M. Kennedy and L. Mackinnon re. the let of Hill Cottage, Monk St. in 1926 which identifies the plot as No.79 on the OS map (see the 1879 edition below).

So, there can be little doubt that the cottage in which Holst worked on Mars, the bringer of war, just before the start of the First World War, was on the right just past the right turn to Sibley’s Green and before the road bends round the left. The cottage was still there in 1948 according to 25″ OS map but by 1977 on the OS map TL 6128 it had disappeared, although the plot still seems to be intact despite road widening and the building of new by-pass to Monk Street, now a left turn off the road.

![Extract from the compotus for the manor of Terling, 1328-1330 (D/DU 206/22), which records the purchase of a watermill [molend’ aquatic] from Prittlewell [Priterewelle] to be moved to Terling.](http://www.essexrecordofficeblog.co.uk/wp-content/uploads/2014/05/D-DU-206-22-Terling-compotus-crop-1024x287.jpg)